Since 1980, US trade policy has been largely pro-trade which has allowed unfettered access to US markets for goods and capital. During this time, countries like China aggressively increased exports via state-supported industries, which distorted the US economy through large trade deficits and lost manufacturing and capital inflows.

Undoubtedly, US consumers have benefitted from inexpensive imported goods. However, trade is a double-edged sword. Less expensive imports mean less demand for US goods which harms US manufacturers and workers. Falling living standards for workers, especially in rural areas, has increased voter frustration and spurred the rise of populism.

This article is meant to provide a basic framework for understanding trade deficits, capital flows, and the implications of remedies like tariffs. After the 2024 election, one thing is clear – voters are tired of listening to pro-trade rhetoric and want results, in the form of higher wages and living standards.

Unfair Trade

Economists tell us that all countries can benefit from trade by exchanging goods from the industries in which they have a low-cost production advantage. While true, countries like China have taken extraordinary measures to support their export industries, benefits which US manufacturers do not enjoy. The Chinese government supports producers with access to cheap credit, lax environmental policies, repression of workers’ wages, and a favorable currency exchange rate. China spends considerable financial effort controlling the value of its currency, the Renminbi. Weakening the Renminbi reduces the prices of goods exported to the US and increases China’s competitiveness. China has used these beggar-thy-neighbor strategies to export subsidized goods to the US and other developed countries, taking market share and crushing competitors.

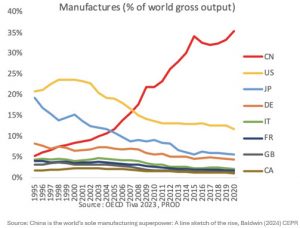

All the inexpensive imports have devastated US manufacturing. From its peak in 1979 to 2019, manufacturing employment in the US has been gutted, with the loss of approximately 6.8 million jobs including a loss of over 80% of employment in the textile industry.i This decline has hit rural communities especially hard given the lack of other well-paying job opportunities in these areas. Since 1979, US manufacturing has declined from 22% of nonfarm employment to just 9% in 2019.ii As seen in the chart below, China comprises a whopping 29% of global manufacturing while only 17% of global GDP.iii

The pace of China’s manufacturing expansion is unprecedentediv and has forced down manufacturing across the developed world.

Trade Imbalances Distort Capital Flows, too

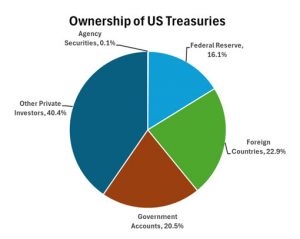

In exchange for goods, foreign surplus economies receive US Dollars which are typically re-invested in US Dollar assets. Exporting countries prefer not to exchange these US Dollars through currency markets for fear of depressing the value of the US Dollar and raising the value of their home currency (or whatever currency they purchased). This preference helps explain why trade deficits are not self-correcting as countries keep US Dollar assets to maintain a currency advantage. For September 2024, the reported monthly trade deficit was $84b, which means foreigners bought roughly $84b in US assets that month. Over time, these purchases of US assets accumulate and are substantial. As illustrated in the chart below, foreigners own over $7 trillion of US Treasuries, which is 22% of the total, and more than the amount the Federal Reserve holds via its quantitative easing programs.v

Economists incorrectly worry that countries may stop buying US debt; exporting countries have little choice but to buy US assets to maintain a trade advantage through exchange rates. The purchase of US assets represents a capital inflow of excess capital as the US has plenty of capital to meet its investment needs – just look at the $2.6t in dry powder at private equity firms.vi Excess capital can lead to asset bubbles and potential economic instability.

Tariffs and Measures to Reform Trade

Countries that run a trade surplus (China, Germany, and Vietnam, for example) should face incentives to consume more of their production at home. Those incentives could include tariffs, capital flow restrictions, and new trade agreements that focus on balanced trade with commitments to curb exports to the US and consume more US exports. During his campaign, President Trump promised a wide array of tariffs, even considering them a meaningful source of revenue for the US Treasury.

While all of these measures have shortcomings, there are a few concerns about tariffs:

- Targeted country tariffs have shown little success. Since 2018, the US has enacted several country-specific tariffs that have had little impact on the overall trade deficit. While targeted tariffs reduced reported trade from China, many exporters rerouted Chinese goods through other countries like Vietnam, Taiwan, and Mexico and avoided paying tariffs.vii

- Across-the-board tariffs will have unintended consequences. While solving the rerouting issue, broad tariffs would likely raise prices for items we may never produce like bananas or popular consumer items like iPhones. Further, across-the-board tariffs will likely increase prices generally, considering the time and investment it takes to relocate production to the US.

Global role of US Dollar

Another point of consideration is the role of the US Dollar as the world’s dominant currency. The US Dollar comprises 54% of foreign trade invoices and 59% of foreign currency reserves.viii Unfortunately, the US pays a cost for the global role of the US Dollar through increased capital inflows and a higher value of the US Dollar. While many believe a strong US Dollar shows US economic strength, it counteracts the effect of tariffs. The US should focus on lowering the value of the US Dollar to help domestic manufacturing and raise the cost of imported goods.

The US may consider a multifaceted approach to fixing trade – well-designed tariffs, limits on foreign asset purchases, and trade agreements focused on balanced trade. Importantly, the US needs to lower the value of the US Dollar through policies that could include reducing the role of the US Dollar in global finance. However, fixing the global trading system will take time.

Takeaways

As we think about pending tariffs from the Trump administration, here are a few takeaways:

- Change is coming: The 2024 election shows that voters believe the global trading system is badly broken and needs to be fixed.ix Tariffs aren’t perfect but may prove a good starting point for a discussion about what the US wants for fair trade.

- Timing: Changes in tariffs will take some time to implement with the earliest impact near the end of 2025. Most likely, higher tariffs will take effect in 2026.

- Higher prices: Imports are 14% of US GDPx, so across-the-board tariffs will have a large economic impact. Goldman Sachs’s tariff rule of thumb is every 10% increase in the US tariff rate would increase inflation by 1.0%.xi

- Manufacturing rebuild: Rebuilding the manufacturing base will take time – think decades given complex supply chains and existing manufacturing bases. Manufacturing companies will want to see durable change before building a new plant, not tariff policies which could change every four years.

At Crestwood, we continue to watch for economic changes that may impact your investments. Importantly, we focus on constructing diversified portfolios designed to weather storms which include changes to industrial policy. Financial markets try to anticipate these changes and frequently overreact based on emotions. We believe it important to keep an eye on the long term and focus on durable changes to policy that may affect financial markets and possibly portfolios. Constructive policies on reshaping trade to a greater balance between imports and exports could have the potential to increase US GDP growth and raise living standards across the US. We will be watchful for policy changes and continue to position portfolios to meet clients’ long-term goals.