We revised this note repeatedly, only to have each version overtaken by new developments. As of April 11, 2025, this represents our latest commentary on tariff announcements; anything introduced after this date will naturally render parts of this update outdated.

On Wednesday, April 2, 2025 – labeled “Liberation Day” by the White House – President Trump unveiled new tariff measures in the Rose Garden, declaring, “The day will always be remembered as the day American industry was reborn.”

Markets React Sharply to Tariffs

The initial U.S. tariff proposals in early March triggered an immediate market downturn, with the S&P 500 falling around 2.0% on Monday, March 4, followed by further declines that effectively erased all post-election gains. A similar negative reaction occurred after the 10% baseline tariff announcement on April 2, and it is likely that markets will remain volatile in the near term.

Will “Liberation Day” Tariffs Meet Their Objectives?

A primary goal of these tariffs is to boost domestic production by making U.S.-made goods more price-competitive, in turn driving economic growth, corporate expansion, GDP increases, and job creation. However, raising tariffs also pushes prices higher and exerts upward pressure on inflation and interest rates—particularly for goods the U.S. produces minimally or not at all, such as steel. Tariffs on steel imports have done little to stimulate U.S. steel production or job growth, and the industry continues to weaken despite the tariffs. Moreover, foreign imports—like specialized foods from Italy—often do not serve as direct alternatives to pricier U.S. items because their unique qualities make them distinct products rather than interchangeable substitutes.

Potentially Significant Economic Consequences

While the ultimate outcome of these tariffs is uncertain, The Budget Lab at Yale, a non-partisan research center, has estimated that tariffs enacted so far in 2025 could increase annual costs for the average American household by $3,800 as food, clothing, textiles, and automobiles would become meaningfully more expensive1. In addition, they project lower GDP in both the short and long term.

Likewise, IMF Managing Director Kristalina Georgieva has noted that the IMF is continuing to study the broader economic implications, but she emphasized that current tariff measures “clearly represent a significant risk to the global outlook at a time of sluggish growth.” 2

Despite widespread speculation about how tariffs will evolve, our focus remains on well-established information while remaining alert to possible opportunities and challenges. It is worth noting that the S&P 500 and other major equity markets have still shown substantial gains over the past two years, and market fluctuations are a normal, expected aspect of investing. Historically, equities have provided robust returns over time, and price drops often present attractive entry points.

Rather than attempting to time the market, remaining invested is generally the strongest strategy for achieving long-term objectives.

Consider the following3:

- Over the last 30 years ending 12/31/24, the S&P 500 had an annualized return of 10.9% per year.

- If you missed the 30 best days out of a possible 7,500 trading days, your return would have 80% lower.

- This is because the best and worst days tend to be clustered together, making market timing a risky proposition.

- 50% of the best 50 days in the market occurred during bear markets!

Capital Markets

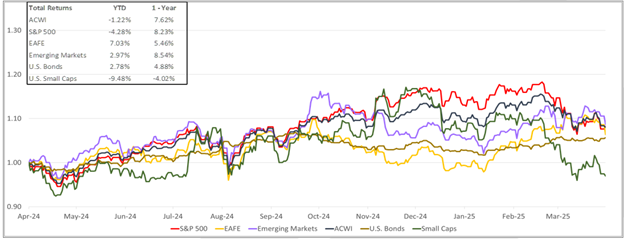

In March, developed equity markets dropped, with the S&P 500 down 5.75%, the Russell 2000 off 6.99%, and the EAFE index slipping 0.90%. Emerging Market equities were a bright spot, edging up 0.38%. Bonds remained nearly unchanged, posting a slight 0.04% gain.

Source: Bloomberg. ACWI is the MSCI All Country World Index, EAFE is MSCI EAFE Index, Emerging Markets is MSCI Emerging Markets and U.S. Bonds is Barclays U.S. Aggregate. Small Caps is the Russell 2000. The above information is as of 3/31/2025.

At Crestwood Advisors, we’re passionate about guiding our clients toward their long-term goals, easing their concerns, and helping them make the most of the opportunities that wealth brings. If you are not yet working with Crestwood, we would love to start a conversation!

1 Where We Stand: The Fiscal, Economic, and Distributional Effects of All U.S. Tariffs Enacted in 2025 Through April 2, The Budget Lab, April 2, 2025

2 Statement by IMF Managing Director Kristalina Georgieva, International Monetary Fund, April 3, 2025

3 FactSet, J.P. Morgan Asset Management, Bloomberg, 2025

This document contains forward-looking statements, predictions and forecasts (“forward-looking statements”) concerning our beliefs and opinions in respect of the future. Forward-looking statements necessarily involve risks and uncertainties, and undue reliance should not be placed on them. There can be no assurance that forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.