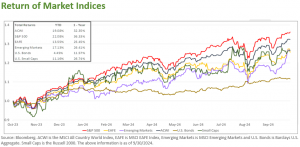

Equity markets finished September higher, after a rough start with the S&P 500 down over 4% during the first week, the biggest weekly pullback of the year. Investors initially fretted over softer than expected August employment that featured negative revisions to prior months and a disappointing ISM manufacturing report. These data points exacerbated existing worries about U.S. election uncertainty, potential further escalation in Middle East conflicts, U.S. labor disputes (port workers and Boeing) and ongoing economic woes in the Chinese economy.

However, several developments reversed this pessimism. The Fed announced a 0.5% rate cut at their September meeting while telegraphing another likely 0.5% in cuts before year-end. The September cut was supported by positive data showing continued disinflation, a stable (albeit slowing) labor market, still-healthy consumer spending, and continued earnings growth projected for U.S. corporations. The soft-landing narrative was further buttressed by initial unemployment claims falling to the lowest level since May.

A 0.5% drop in policy rates is significant paired with the Fed’s updated Statement of Economic Projections (aka their “Dot Plot”) penciling in another 1% in cuts during 2025 and 0.5% in 2026. Car loans, credit cards, some adjustable-rate mortgages and some other forms of borrowing are based on the Prime Rate, which typically runs approximately 3% above the Fed Funds rate. Thus, a full 1% drop in the Fed Funds rate by year-end would represent a meaningful reduction in borrowing costs for many U.S. consumers.

When Will Fed Rate Cuts Help Homebuyers and Refinancers?

The short answer is “Eventually.” Unlike the Fed Fund rate, which is decided by the Fed, mortgage rates tend to be closely related to 5-year Treasury yields, which are driven primarily by supply and demand factors. These yields tend to rise when the economic outlook is strong and fall when the economic outlook is weak. Over time, Treasury rates tend to follow the direction of changes in the Fed Fund rate.

- The caveat is that mortgage rates don’t always adjust at the same pace:

When the 5-year yield is rising, borrowing rates tend to go up quickly as lenders are eager to offer loans at higher and higher rates while the economic outlook appears strong. From their perspective, this is a win-win: they’re charging higher rates to borrowers in an environment where defaults are less likely. - Not surprisingly, when 5-year Treasury yields are falling, lending rates don’t fall quite as fast as they rose. In other words, when the economic future looks more uncertain, lenders prefer to keep rates higher for longer to hedge against future risk.

- This phenomenon is observable in the chart below: the gap between 5-Year Treasurys (yellow line) and 30-year average Fixed Mortgage Rates (white line) is minimal when rates are rising (as in 2022) but tends to widen when rates are flat or declining.

The takeaway: Homebuyers and refinancers should be optimistic that lower rates on mortgages are coming, however they should also expect that these lower borrowing costs for consumers may lag the decline in Fed rate cuts.

Chinese Equity Markets: Avaricious Stimulus

During the last week of September, Chinese equities rose nearly 20% in response to the Chinese government’s announcement of a tidal wave of stimulus measures intended to jump start their economy. The stimulus included cuts to mortgage rates, a decline in down payment requirements for second homes, relaxed capital reserve requirements for banks, and a large stimulus program that explicitly incents brokers, insurance companies and other entities to buy Chinese stocks.

While this caused Chinese stocks to move into positive territory for the year, it does little to address fundamental issues plaguing their economy. China still faces weak retail sales, falling real estate prices, and a crippling dependence on government investment, rather than consumption, to maintain growth. Perhaps worst of all is that the heavy hand of communist rule has undermined shareholder rights, especially those of foreigners. In June this year, foreign direct investment in China turned negative for only the second time since 2005.

Despite the recent rise in Chinese equity prices, we continue to believe investors should be wary of rallies driven by government spending and policies intended to entice speculative investments.

Capital Markets

Equity and fixed income markets rose in September. The All-Country World Index (ACWI) rose +2.17%, the S&P 500 rose +2.02%, while the EAFE rose +0.62%. Emerging markets surged with a gain of +6.68%, driven primarily by the aforementioned move in Chinese equities. U.S. Bond prices rose +1.34% for the month.