With Monday’s -3.9% decline, the S&P 500 has now fallen over 20% from a January peak and officially entered ‘bear market’ territory. Down markets grab headlines and swiftly erase gains that have been made over what feels like years.

In risk assets the selloff has been more of a meltdown, especially for cryptocurrencies. Bitcoin, crypto’s bellwether, has fallen -21% in the past 3 days and is now down over 66% since November. Last month, so-called stablecoin, TerraUSA, plummeted from $80 to near $0, wiping out over $80 billion in value in 5 days. Recently, crypto lending platform Celsius has faced a liquidity crisis and the price of their coin has fallen below $0.33. Since November, the total market capitalization of cryptocurrencies has fallen from $3 trillion to below $1 trillion.

Stock markets have been selling off since Friday’s Consumer Price (CPI) report for May which showed that inflation rose to 8.6% year over year – a new 40-year high. Investors were expecting CPI to begin to moderate so this report was a major disappointment. It showed that price increases have become broad-based across the economy and more ingrained in consumer expectations, which is bad news for slowing inflation back down.

In hindsight, the Fed erred by not acting early enough and believing inflation was initially transitory. They are now laser focused on getting inflation under control. Historically, raising interest rates has been a very effective tool for slowing economic growth and thereby curbing inflation. Unfortunately, concern is now rising that the Fed will raise interest rates at an aggressive clip that might dip the economy into a recession. After the CPI report on Friday, markets expectations for the Fed Funds rate jumped higher to 3.5% by year end from 1.0% today.

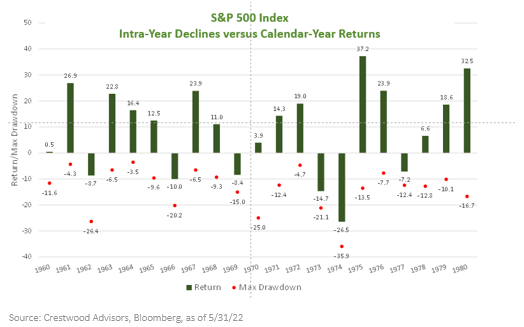

Today’s rampant inflation and rising interest rates reminds many of the 1970’s when the price of gas rose sharply due to the OPEC embargo and gas shortages across the U.S. Though the economic data is different this time (tight labor markets, strong consumer balance sheets, etc.), the inflationary headwinds rhyme and until the Fed is successful, investors will have to live with uncertainty and market volatility. The below chart looks back at the annual performance of the S&P 500 Index (Green bars) and the intra-year market decrease (Red dot) for each year:

Clearly, markets were volatile (and difficult) then as they are now but, importantly there were periods that provided positive returns for the patient and prudent investors.

Growing Recession Fears

Most economist believe that the average growth rate of the U.S. economy is currently between 2.0% and 3.0%, so any Fed induced slowdown has a risk of overshooting and causing a recession. After the Global Financial Crises in 2008/09, investors expect that a recession would again collapse stock prices.

We believe there are three reasons why today’s recession-will-kill-the-stock-market concerns may be overblown. First, consumer debt ratios are now in the best shape during post war history, making a prolonged downturn like the Global Financial Crisis less likely. Second, earnings of corporate America remain healthy with EPS growth of over 9% for the S&P 500 in first quarter. Third, investors appear to be pricing in a recession, by driving indexes into a bear market. However, economic growth is still healthy and expected to grow ~3.0% this year, so the markets seem to be pricing in a lot of bad news.

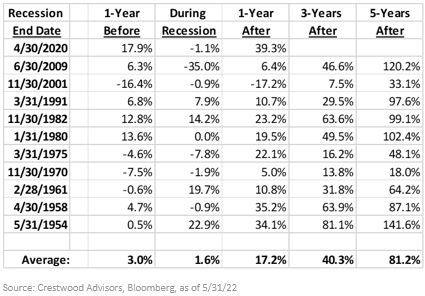

Looking at stock market returns before, during and after recessions, demonstrates that returns have been more mixed:

Since 1950, on average, stocks have shown modest gains before and during recessions. Sometimes stocks fall before a recession as in the recessions ending in 2001 and 1970. There are even cases of stocks rising during recessions – 1954, 1961 and 1991. Most promising is that after a recession ends, stock market returns have been excellent with 1-year, 3-year and 5-year returns up 17.2%, 40.3% and 81.2%, respectively.

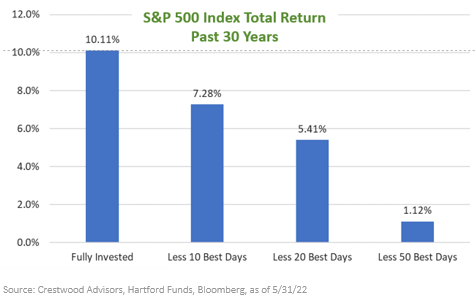

Given the high level of uncertainty in the economy and markets, it is important to remember to stick to your investment plan. Selling stocks after a 20% decline usually turns a temporary loss into a permanent one. Staying invested is critical especially considering the impact of missing the best days in the market.

Over the last 30 years, missing the best 50 days in the market erases 89% of your return. That is missing just 50 days out of 7,500 trading days! Surprisingly, 50% of the best 50 days occur during bear markets! Selling during periods of stress and buying when the outlook is clearer, will usually hurt long-term returns.

As investors, we recognize how disconcerting this volatility can be no matter what your investment horizon. As we have watched markets sell off, we’ve been comforted that many of the businesses you hold continue to see strong operational success, with many businesses showing an ability to pass price increases to their consumers. This is unlike previous bear markets which typically see lower earnings and more cautious outlooks. While the stock prices are lower, the businesses you are exposed to continue to deliver robust earnings and strong free cash flow which will allow them to not just survive the current challenges, but also gain market share. As markets are forward looking, they will typically turn upwards well before a recession has ended. We know it is not easy, but staying invested through these difficult times is the best way to maximizing your risk adjusted returns over time and ensuring you participate in the future recovery.