As we look back at 2024, we want to summarize the major economic highlights of the year.

Economic Data Mostly Positive

US economic growth, job creation, and inflation continued to improve through 2024, though progress came with some caveats.

• Stable GDP Growth: GDP came in at a 1.6% for Q1 2024, the lowest since Q2 2022, but Q2 2024 came in at 3.0% and Q3 2024 at 3.1%.

• Non-farm employment rose by ~2.2 million jobs from January through December, though the unemployment rate moved up to 4.1%, 0.5% higher than December 2023. 4.1% is still a low figure compared to the longer-term average of 6.2% but does reflect a slowing pace of US growth.

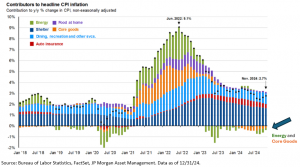

• Inflation improving (for now). The consumer price index (CPI) was up 2.7% and core CPI was up 3.3% year/year in November. This is a marked improvement from the 3.3% and 3.9% pace in December 2023. However, as shown in the chart below, it’s noteworthy that declining prices in core goods (in orange) slowed in the second half of the year and lower energy costs (in green) contributed to much of the decline in total inflation for the year. This suggests that independent of other potential inflationary factors (wage pressure, tariffs, etc.) we could see inflation pick up, should energy prices reverse course.

Fed Preached Patience before Cutting Rates

Early in 2024, investors questioned when the Fed would begin the process of easing from the 5.25-5.5% peak, maintained since August of 2023. It took until August 2024 before Fed Chair Powell’s announcement that “the time has come for policy to adjust”.

September’s FOMC meeting resulted in a 0.5% cut, followed by 0.25% cuts at the November and December meetings. Notes from the December FOMC meeting, as well as a revised Summary of Economy Projections (aka the “Dot Plot”) suggest the Fed may delay further cuts in the near term with rates falling a further 0.25-0.5% by the end of 2025. That’s both a slower pace and a higher end rate than many investors expected.

US Equity Markets Rally Immediately Post Election Before Ending on Mixed Note

The market’s initial reaction was positive, with both the S&P 500 and the Russell 2000 logging their best monthly performances of 2024 during November. This reflected investor optimism about several factors, notably:

• A further lowering of the corporate tax rate from 21% to either 20% or 15%. This would be a huge boon to corporate earnings and like push stock prices higher. For perspective, the highest 2016 marginal rate was 35%.

• An extension of the 2017 personal income tax rate cuts set to expire in 2026. If this were to sunset, US consumers would have less money to spend on discretionary purchases.

• Deregulation: This could boost domestic energy production, lower the barrier to mergers and acquisitions, and usher in a pro-crypto administration.

However, a narrowly averted government shutdown in December raised questions about how effectively President Trump will be able to use Republican congressional majorities. Equity markets pulled back amidst a backdrop of speculation about tariffs, disruption with long-time trading partners (Mexico, Canada) and the US potentially assuming control of Canada, the Panama Canal and/or Greenland. Collectively these are distractions and potential disruptions from the pro-business policies noted above.

Corporate Earnings – Strong but Top Heavy

S&P 500 constituents posted average year/year EPS growth of 5.8% in Q3, which was the fifth consecutive quarter of positive earnings growth. Q4 results are forthcoming, but S&P 500 firms are forecast to record annual earnings growth of 9.5%, which exceeds the ten-year average of 8.0%. The Mag 7 names (Apple, Microsoft, Amazon, Alphabet, Meta, NVIDIA and Tesla) accounted for a disproportionate share of earnings growth estimated at 33% vs 4% for the “Non-Magnificent 493”.

Looking ahead, analyst estimates for 2025 in aggregate are an optimistic 14.8% based on expectations of durable EPS growth, progress on inflation and a favorable regulatory backdrop from the incoming administration. Importantly, analysts expect broader based earnings growth with a stronger contribution from companies outside the Mag 7 names which dominated earnings and returns last year.

Capital Markets

Both equities and bonds pulled back in December, capping off an otherwise strong year. The S&P achieved its second straight year of 20%+ gains for the first time since 1998, hitting 57 new record highs in the process. Small caps were a winner in November, but reversed course in December, falling -8.4%. The All-Country World Index (ACWI) and the S&P 500 both declined -2.5%, while developed international equities a measured by the EAFE index fared slightly better with a -2.3% decline. Emerging market equities were down only slightly by -0.3%. Bonds declined -1.6%.