With the election results now in, many investors are wondering if they should adjust their portfolio strategy. We have written in the past about how political affiliation can frame investors’ perception about the economic environment.(1) This month, we discuss how that carries over to trading behavior.

Bias and Sell us

Politics have a marked influence on an investor’s perception of the market and their ability to evaluate risk. Interestingly, this phenomenon isn’t limited to “retail” investors trading via Robinhood, but extends even to sophisticated investors, such as hedge funds.(2)

Research on investor psychology reveals that investors of all skill levels report feeling more optimistic and view markets as less risky and more undervalued when their preferred political party is in power. Conversely, they often maintain a lower weighting in risk assets, like equities, when the opposing party holds power, regardless of market or economic conditions.(3)

For example, following the 2016 election, a greater proportion of GOP-identified mutual fund managers increased exposure to equities than Democrat-identified mutual fund managers. Likewise, retail investors in predominantly GOP-leaning zip codes increased their equity allocations more than those in Democrat-leaning areas.(4)

Thus, following the 2024 election left-leaning investors may be thinking about how to position their portfolios defensively while right-leaning investors may be seeking opportunities to invest more aggressively.

A Quick Refresher

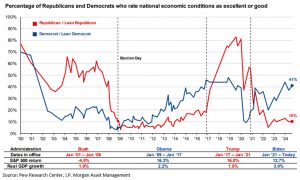

As shown in the chart below, market returns during the Obama and Trump administrations were almost identical (+16%), far above the 30-year average of 10%. Despite similarly strong equity markets, surveys consistently show that individuals rated economic conditions more favorably when their preferred political party wins an election or was currently in power and less so when their party wasn’t in power.

Rather than Gambling on Red or Blue, Invest in Black and White

In the last few weeks, we have seen flows in and out of areas dubbed “Trump Trades” such as cryptocurrencies, banks, and pharma companies. However, it is difficult to do well in the long run by speculating on political agendas.

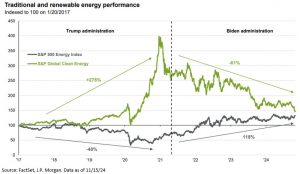

For instance, during the 2016 election cycle Trump campaigned to support the traditional oil and gas industries during his presidency. On the other hand, Biden campaigned to support renewables and promised to reduce exposure to fossil fuels.

However, sector performance was exactly the opposite of what politically focused investors expected. Under Trump, the S&P 500 Energy index, which held oil and gas companies fell 40%, while the S&P 500 Global Clean Energy index rose a remarkable 275%! Conversely, under Biden the S&P 500 Energy index nearly doubled, while the S&P 500 Global Clean Energy index fell more than 60%.

At the end of the day, market performance is shaped by macroeconomic forces. Fluctuations in supply and demand, along with changes in interest rates around the world, had a greater impact than any policies from the White House.

Ultimately, it is policy rather than political posturing that drives the economy. Thus, investors would do well to maintain diversified portfolios of companies with good balance sheets, strong cash flows, and solid business models regardless of political change. Your equity allocation should be driven by your financial plans and time horizons, rather than election outcomes. Maintaining a long-term focus is the key to achieving your financial success.

Capital Markets

The S&P 500 is on pace to see the first back-to-back years of annual gains of 20%+ since the 1995-1998 market run, but U.S. small caps were the star of the month, rising by 10.8%. The All-Country World Index (ACWI) rose 3.8%, the S&P 500 climbed 5.7%. However, international equities underperformed due to a stronger dollar and trade concerns, with the EAFE down 0.7% and emerging market equities down 3.7%. U.S. Bond prices rose slightly by 1% for the month.

This document contains forward-looking statements, predictions and forecasts (“forward-looking statements”) concerning our beliefs and opinions in respect of the future. Forward-looking statements necessarily involve risks and uncertainties, and undue reliance should not be placed on them. There can be no assurance that forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

1. See our May 2024 Economic Update “How Politics Influence Perception of the Economy”

2. Source: “Hedge Fund Politics and Portfolios”, DeVault and Sias June 2016

3. Source: “Political climate, optimism, and investment decisions”, Bonaparte et al, May 2017

4. Source: “Partisanship and Portfolio Choice: Evidence from Mutual Funds”, Cassidy and Vorsatz, January 2024