What’s Happening In Equity Markets?

The new year has started with a tumultuous U.S. stock market and the broader economic and investment environment is one of heightened risks. COVID remains a central theme and is contributing to inflationary pressures (i.e. strained supply chains, production slowdowns) and impairing the workforce and productivity, causing slowing GDP growth expectations. Concerns over accelerating inflation has caught the attention of the Fed and markets are now pricing in 3-4 rate increases and a shift from Quantitative Easing (QE) to Quantitative Tightening (QT). The shift to QT will be a difficult balancing act as “too slow” may not sufficiently dampen inflation and “too fast” risks a recession. Neither of these outcomes are great for investors so we’re likely to see some stock market swings as investors judge the relative success of the Fed.

The concerns of tighter monetary policy and a slowing economy have already been hitting the “growthiest” stocks and other speculative investments. “Meme” stocks are buckling, pandemic darlings like Peloton & Zoom have cratered and even the “future of money” cryptocurrencies are down significantly. Cathie Wood, founder of ARK Innovation funds, got a lot of attention in 2020 as her “disruptive innovation” ETF strategies exploded higher have now lost ~50% over the past year. Even with such carnage, too many money-losing tech companies remain generously valued based on robust growth expectations that may or may not be forthcoming. A world with QT and higher interest rates makes the potential for profitability more difficult and tossing in a recession ensures some of these types of businesses will be lucky to survive.

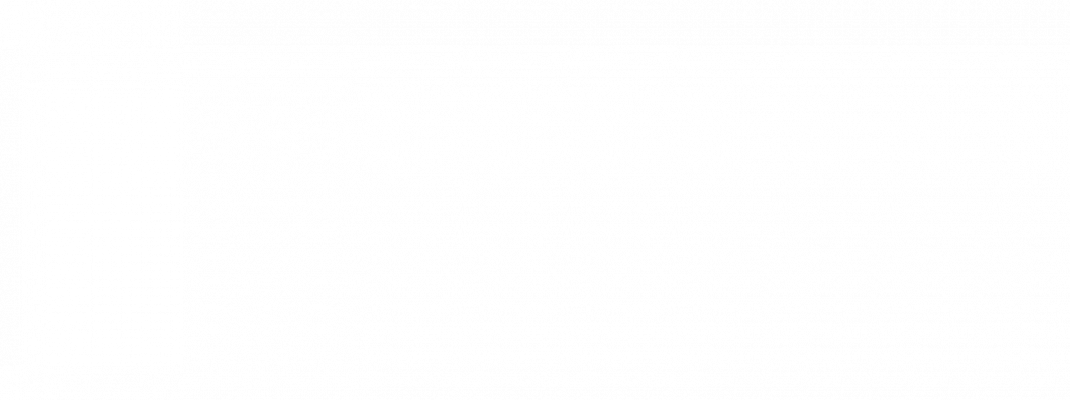

While stock prices for many individual companies are down significantly with many stocks trading well below their 200 Day moving average (see chart below), broader market indices are down more modestly. So far in 2022, the tech-heavy NASDAQ composite is down about 13%, the S&P 500 is down 8% and the Dow Jones Industrial Average is down a bit more than 6%.

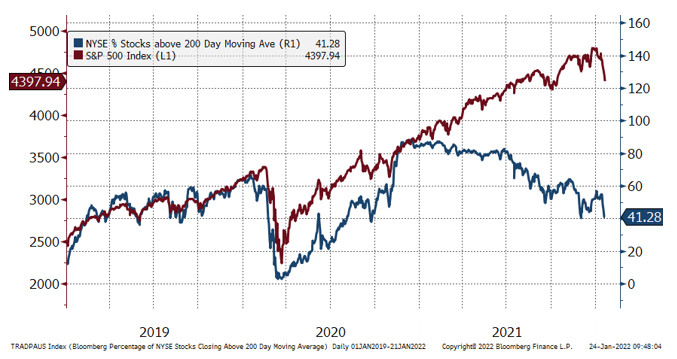

A closer look at the S&P 500 shows some of the risks as well as some explanation as to why this index continues to hold its ground. As highlighted in the chart below, 5 stocks (Microsoft, Amazon, Alphabet, Meta, Apple) have dominated the S&P 500 index in recent years and the performance gap between the “S&P 5” and “S&P 495” has exploded ever wider over the last 24 months. We have been fortunate to widely own AAPL, GOOGL & MSFT during this time given what we believe are their strong operational characteristics and favorable valuation levels. Today, if you add Tesla to this group, the top 6 stocks represent about 25% of the total S&P 500. This is highly unusual and the last time stock markets were so concentrated in just a few names was in tech boom of late 1990s, which didn’t end so well when investors eventually began to question the growth assumptions built into the rich valuations of those stocks.

Importantly, this does not suggest we are on the precipice of a similar market “crash” as we experienced when the tech/telecom bubble burst in the early 2000s, but we do not believe this performance gap is sustainable. The concentration of the S&P 500 in just a handful of companies presents a heightened level of risk for the market, especially should anything (i.e. slowing growth, more aggressive regulation, etc.) specifically adverse happen to any of those 5-6 businesses.

In general, with the possible exception of Tesla, valuations of these top stocks are much lower than what occurred during the tech bubble of the late 1990s. The charts below highlight how AAPL, MSFT, GOOG & FB generate enormous cash flow and are significantly more profitable companies vs. the S&P 500.

Where we see opportunity?

We believe near-term weakness and enhanced volatility creates longer-term opportunity. While GDP growth may slow, the economy is still expanding and consensus earnings growth for the S&P 500 is expected to be up nearly 10% for 2022. Higher interest rates may adjust market multiples lower but, as always, we believe businesses with leading positions in secular growing industries that are self-financing with strong positive cash flow will have advantages in both a slowing economy and during any QT when access to outside capital becomes more difficult. Our portfolios are filled with such businesses and we remain committed to investing in a diversified portfolio of such strong businesses in order to mitigate risk and protect against an always unknown future.

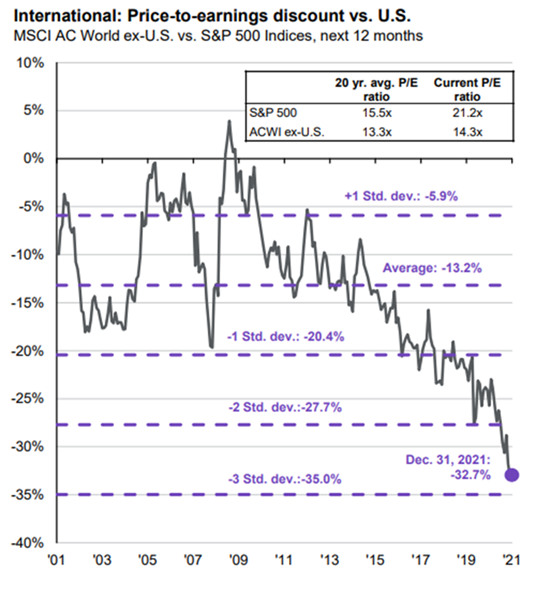

It is also worth noting, that the U.S. stock market’s “advantages” vs. the rest of the world may be fading and valuations of international stocks relative to the U.S. have grown extraordinarily wide (See chart below). Last year, the U.S. got an economic & profit boost from more front-loaded monetary (i.e. asset purchases) and fiscal (i.e. the direct stimulus payments) policies but these are now largely done or slowing. In contrast, the Eurozone had more backend- loaded measures including loan guarantees to businesses/individuals and broader reserve lending, which may lead to faster earnings growth vs. the U.S. in 2022. Given current valuation levels, this would boost relative returns from international & emerging market stocks.

What you should expect

We remain disciplined in our approach to constructing risk-appropriate portfolios that enhance the opportunity for each client to achieve their individual goals. Generally speaking, this includes a healthy allocation to sometimes volatile equities. Stock market volatility is always uncomfortable but periodic declines in stock prices are an unfortunate part of the experience in seeking the higher long-term returns offered by investing in the stock market. March 2020 was the last significant downturn in stocks and we don’t know whether the current weakness will prove to be as short-lived but we do see a constructive economic environment supported by a recovering labor market and solid corporate earnings growth. We intend to use any near-term weakness and volatility to improve portfolios, perhaps adding to current investments that may trade lower but where we see our long-term thesis for the business intact. Likewise, our research team continues to evaluate opportunities that any further market weakness may make more attractive.

Extreme valuations and get-rich-quick schemes like retail investors chasing “meme” stocks distort performance and will eventually harm those who got in too late. While the unwinding of the more speculative investments may take time and involve some pain, a renewed focus on the importance of business fundamentals together with a rational long-term investing will increase market stability and reward those with a disciplined consistent approach.

Should you like to discuss the current environment or other matters related to your investment portfolios, we encourage you to reach out to your Wealth Team.

We remain humble and grateful for the opportunity to be working with you.