Crestwood believes equities offer strong growth potential for long term investors. We continuously analyze capital markets trends and data to inform our long-term equity strategy and identify shorter-term opportunities. Our analysis indicates that, given current market conditions, U.S. Small/Mid (SMID) cap stocks have the potential to outperform large cap stocks.

SMID Currently Trading at a Wide Discount

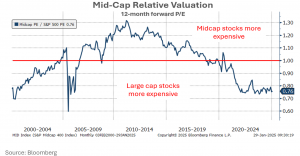

For much of the past 30 years, U.S. Small/Mid (SMID) cap stocks have traded at a premium valuation compared to their U.S. large-cap counterparts. Traditionally, investors sought SMID cap stocks to gain exposure to higher expected earnings growth to complement more mature and relatively slower-growing large-cap stock holdings. However, since early 2021, SMID cap stocks have traded at valuation discounts relative to large-caps in a range not experienced since the 2000 tech bubble. We believe this discount represents an attractive investment opportunity.

Below is a chart demonstrating the price-to-earnings ratio of the mid-cap stock index to that of the large-cap S&P 500 index for the past 20 years. Notably, mid-cap stocks currently trade at a 24% discount to large-cap stocks.

In the shadow of the Mag 7

For the past two years, investors have focused on the Magnificent Seven (Mag 7) companies – Apple, Microsoft, Alphabet, Amazon, Meta Platforms, Nvidia and Tesla – which have been a significant driver of large-cap stock market performance. Since January 2023, these stocks surged 254%, compared to the S&P 500’s 63% gain. Impressively, the Mag 7 companies have grown earnings by over 130%, capturing investor enthusiasm, especially for those benefiting from the development of artificial intelligence platforms. Enthusiasm for AI focused companies has overshadowed small-cap and mid-cap stocks which have fallen out of favor.

Attractive characteristics

When examining valuation as an investment factor, it is essential to ensure underlying fundamentals are healthy. Sometimes investments may appear inexpensive but carry low valuations for good reason and are priced appropriately. When looking at the stocks in the small-cap and mid-cap indexes however, we believe their fundamentals are healthy and improving:

1. Faster Growing: Over the past seven years, SMID cap earnings have grown faster than large cap earnings and they are expected to continue growing faster in the coming years.

2. Improving Businesses: Over the same time frame, SMID caps have improved free cash flow yields, margins, and returns on invested capital to comparable levels to large caps.

3. No Substantial Increases in Debt: Both SMID and large-cap debt levels are at their historical averages.

Why Now?

Several catalysts make now an opportune time to increase our exposure to SMID cap stocks:

1. Economic growth: SMID cap earnings tend to be more cyclical and rise and fall with economic growth. The current economic outlook is for healthy consumer spending and a resilient job market

2. Deal Activity: Anticipation of reduced regulatory scrutiny under the Trump administration is fueling expectations of increased merger and acquisition (M&A) activity. Higher M&A activity is a positive catalyst for SMID caps as they are often targets for these types of deals.

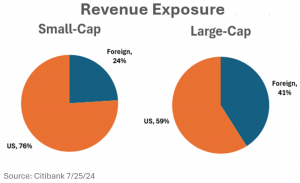

3. New Administration Tariffs: How substantial, impactful, or disruptive the tariffs may or may not be is still widely unknown. However, SMID caps have roughly half the exposure to foreign revenue as large caps, making them an attractive diversifier against potential global trade disruptions caused by tariffs.

In summary, SMID cap stocks are notably underappreciated by the broader market, presenting a compelling investment opportunity. Given today’s favorable economic environment, we believe their strong fundamentals combined with attractive valuations offer an appealing opportunity and may offer an important return and diversification benefit to client portfolios.

Sources: Bloomberg, Citibank. Mid-Cap stocks are represented by the S&P 400 Index, Large-Cap stocks are represented by the S&P 500 Index. The Magnificent Seven (Mag 7) returns are represented by the Bloomberg Magnificent 7 Index.