As global financial markets react to news that the novel Coronavirus (2019-nCoV) continues to spread, we want to share an overview of these latest developments.

About:

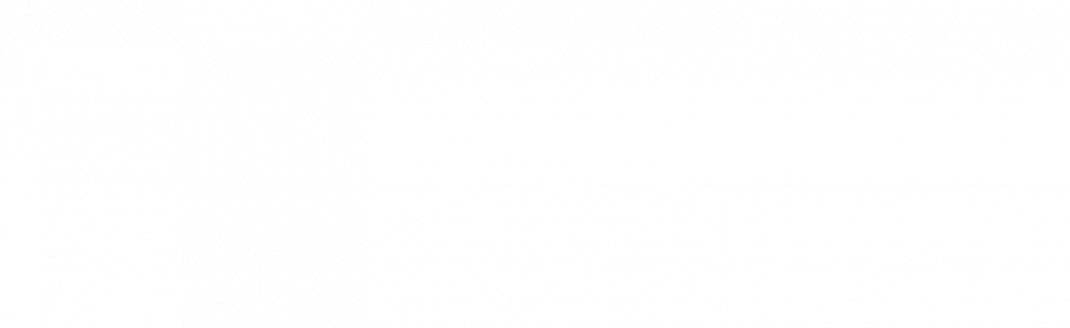

First confirmed in Wuhan, China in December, the coronavirus has grown to over 4,500 confirmed cases within China as we write this. The virus is similar to MERS and SARS where all three are coronaviruses, contracted and transmitted through close contact with animals or humans. Though concerning, the mortality rate for this virus is thus far lower than that for SARS and MERS. However, recent reports that this novel coronavirus is contagious prior to symptoms showing may make it harder to contain. Observed symptoms include cough, fever, and possibly shortness of breath. Please see the chart below for a comparison.

Action:

China has instituted a travel ban on trains and planes departing the country, along with quarantining cities where the virus is believed to have originated or spread. Furthermore, China has completely banned trade of wild animals. Along with China, countries globally have released statements to discourage travel to China. Compared to SARS and MERS, 2019-nCoV public disclosure and action has been far more efficient, giving hope to controlling the virus more effectively than past coronaviruses.

Outlook:

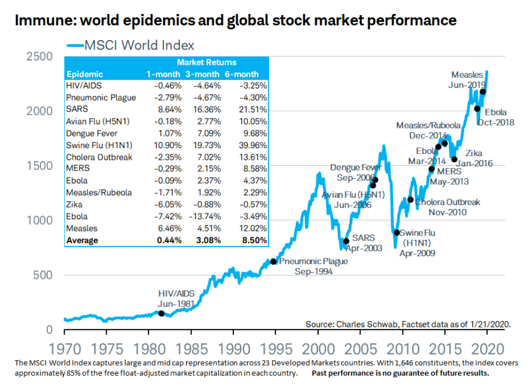

Headline risk, uncertainty, and a known decrease in travel during the Lunar New Year (typically one of the most traveled times of year) have been the main reasons for recent market reaction, both domestically and internationally. While the virus may have a negative impact on sectors relying on travel, tourism, and Chinese production, we believe any weakness will be temporary.

Based on our current understanding of available data, we do not see this novel coronavirus having a significant lasting negative effect on U.S. GDP growth. We continue to believe in the underlying strength of the economy given strong labor markets, high savings rates, and positive household financial balance sheets. Looking back at the SARS outbreak in 2002-2003, while unnerving, there was no long-term impact to the financial markets.

These types of events are always a reminder of the importance of long-term investment horizon, as temporary periods of weakness should be expected.